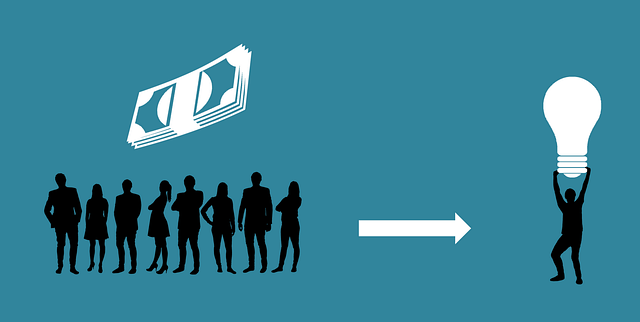

Crowdfunding empowers startups to raise capital online by engaging passionate communities and transforming them into invested supporters. Through crowdfunding platforms, entrepreneurs gain market validation for their business ideas, receive valuable feedback, and foster early adoption while securing startup funds. This approach also engages potential customers, builds investor trust, and leverages the crowd's power to refine business models and drive growth.

In today’s digital era, securing seed funding through online platforms has emerged as a powerful alternative to traditional investment methods. This article explores the transformative power of crowdfunding for startups, delving into its multifaceted benefits, including robust business idea validation and successful campaign measurement. We’ll navigate popular crowdfunding platforms, dissect their compelling features, and highlight inspiring case studies. Additionally, we’ll uncover strategic approaches to engage potential customers, ensuring a thriving online community drives startup success in raising capital.

- Crowdfunding Benefits for Startups

- – Understanding the advantages of crowdfunding

- – How it helps in business idea validation

Crowdfunding Benefits for Startups

Crowdfunding offers startups numerous benefits when it comes to raising capital online. One of the key advantages is its ability to engage potential customers directly, transforming them from passive observers into invested supporters. By showcasing their business idea and passion on crowdfunding platforms, entrepreneurs can build a community around their venture, fostering early adoption and word-of-mouth promotion. This not only helps in securing startup funds but also provides valuable feedback and validation of the market’s interest in the product or service.

Additionally, crowdfunding allows for flexible funding models, enabling startups to tailor their campaigns to suit their needs. It promotes transparency as well, as campaign details and milestones are readily available for public view. This transparency can build trust with investors and contribute to a more successful fundraising effort, ultimately paving the way for a stronger financial foundation for the business.

– Understanding the advantages of crowdfunding

Crowdfunding offers numerous advantages for entrepreneurs seeking to raise capital online and validate their business ideas. By leveraging popular crowdfunding platforms, founders can tap into a vast network of potential customers and investors who are eager to support innovative projects. This not only facilitates the securing of startup funds but also provides valuable feedback and market validation for your business concept.

One of the key benefits of crowdfunding is its ability to foster engagement with your target audience. Through interactive campaigns, you can directly connect with people interested in your product or service, building a community around your brand. This engagement not only helps in raising funds but also serves as a powerful marketing tool, as satisfied backers can become advocates for your business, spreading awareness and potentially driving future sales.

– How it helps in business idea validation

Raising capital for a new business venture can be daunting, but online crowdfunding platforms offer a powerful solution for entrepreneurs seeking to validate their ideas and secure startup funds. By leveraging the crowd’s wisdom, businesses can gain valuable insights into market demand and customer interest. These platforms allow founders to pitch their concepts directly to a global audience, engaging potential customers who might become loyal supporters or early adopters.

The benefits of crowdfunding extend beyond financial support. It provides an opportunity for entrepreneurs to refine their business models, gather feedback, and build momentum before officially launching. With the ability to attract attention from investors, angel investors, and venture capitalists, successful crowdfunding campaigns can open doors to further funding opportunities and accelerate business growth.